2025 AND THE ART MARKET: SIGNS OF STABILIZATION, NOT YET RECOVERY

As 2025 draws to a close, the long-anticipated recovery of the global art market has not yet truly taken shape. The cautious optimism that marked the end of 2024 quickly gave way to a more sobering reality.

Far from rebounding, the market struggled through a weak first half of the year, further weighed down by geopolitical and economic pressures, including the introduction of new U.S. tariffs that dampened confidence and cross-border activity. It was only in November, with a series of stronger auction results, that sentiment began to stabilize. This late-year improvement was also reflected in the results reported by Christie’s and Sotheby’s, both of which closed 2025 with higher total sales than in the previous year.

While auction results improved toward the end of the year, outcomes across the gallery sector remained more uneven, as became evident during Miami Art Week, where sales reports were mixed, although no worse than the previous year. This divergence between stronger auction performance and continued caution in the gallery market does not signal a recovery, but it has reopened the possibility that 2026 may finally mark a gradual improvement.

It is important to note that much of this analysis is grounded in auction data, which remains the most transparent and consistently available source, while assessments of the gallery sector inevitably rely more on reported experiences, conversations, and qualitative insights rather than comprehensive public figures.

Single-Owner Collections and a Shift in Market Psychology

One of the most striking features of 2025 has been the central role played by single-owner collections in restoring confidence. Landmark estate sales provided not only liquidity, but also reassurance. They also reinforced the sense that competition remains strong when material is perceived as both rare and irreplaceable.

It is important, however, to nuance this narrative. Many of these collections entered the market not because sellers believed conditions were ideal, but because external factors made selling unavoidable. Inheritance planning, estate settlements, and generational transitions have been decisive drivers. In that sense, the recovery has been propelled less by optimism than by necessity. Nevertheless, these sales have recalibrated expectations and helped reset pricing benchmarks after several years of readjustment.

-

María Sancho-Arroyo in conversation with collector Armando Andrade. FORO Pinta Miami 2025. Courtesy Pinta

Segment Divergence and the Search for Stability

Beneath the headline figures, 2025 reveals a fragmented market, with performance varying sharply across segments. Auction sales of Contemporary art declined year-on-year, with the contraction particularly pronounced in the Young Contemporary segment. Despite this adjustment, the number of young artists appearing at auction remains elevated compared to historical averages, suggesting that supply has not yet fully aligned with demand.

The Post-War sector also experienced notable pressure, driven largely by pullbacks among artists who had been among the strongest performers in recent years. By contrast, the Modern art category showed renewed vitality. Increased availability of trophy-level works, combined with strong international demand, produced robust results for several canonical artists.

This divergence invites a broader interpretation. The growing supply of Modern masterpieces may reflect a generational shift, as collections assembled decades ago are gradually redistributed. Estate dynamics, inheritance taxes, and changing tastes among heirs all contribute to this trend. At the same time, this renewed focus on established names can also be read as a familiar market response to a softer environment. In periods of uncertainty, collectors tend to gravitate toward artists with long-standing institutional validation, museum presence, and a proven track record both in major collections and at auction. These artists are perceived as safer propositions than newer contemporary names, whose markets are often more exposed to volatility. In this context, the relative strength of the Modern segment reflects not only increased supply, but also a broader reallocation of demand toward historically established and institutionally endorsed figures.

-

Auctioneer Oliver Barker conducts the sale of Frida Kahlo’s El sueño (La cama) (1940) at Sotheby's in New York on 20 November. Courtesy Sotheby's

Guarantees, Risk, and the Retreat of Speculation

The continued softening of the Young Contemporary sector has also been accompanied by a contraction in the use and value of evening sale guarantees. This development is significant. Over the past decade, guarantees often underpinned aggressive pricing and contributed to speculative momentum. Their retrenchment in 2025 suggests a more cautious approach by both auction houses and third-party backers, and a broader reassessment of risk. Rather than signaling weakness, this shift may be read as a necessary correction. A market less dependent on financial engineering and short-term speculation may ultimately prove more resilient, even if volumes remain lower in the short term.

Structural Changes Beyond the Auction Room

Beyond auction results, 2025 has been marked by deeper structural transformations. Rising operational costs and tightening margins have forced many galleries to close or rethink their business models, even as others have expanded selectively or entered new markets. The resulting landscape is one of contraction and reinvention rather than collapse.

Parallel to this, consolidation and collaboration have accelerated. Dealers, advisors, and platforms are increasingly pooling resources, sharing infrastructure, or formalizing partnerships. Given that overall art market turnover has remained broadly flat for more than a decade, this move toward scale and efficiency appears less a temporary response than a structural inevitability.

New Geographies and New Collectors

Geographically, the growing prominence of the Gulf region has been one of the most consequential developments of the year. Significant investment in cultural infrastructure, the launch of major international fairs, and the expansion of auction activity all signal a long-term ambition to reposition the Middle East as a central node in the global art ecosystem. Beyond cultural strategy, the region also offers what the art market consistently seeks: liquidity, a growing base of high-net-worth collectors, and a regulatory environment that is often perceived as more flexible than in traditional Western centers.

-

Doha. Courtesy Art Basel

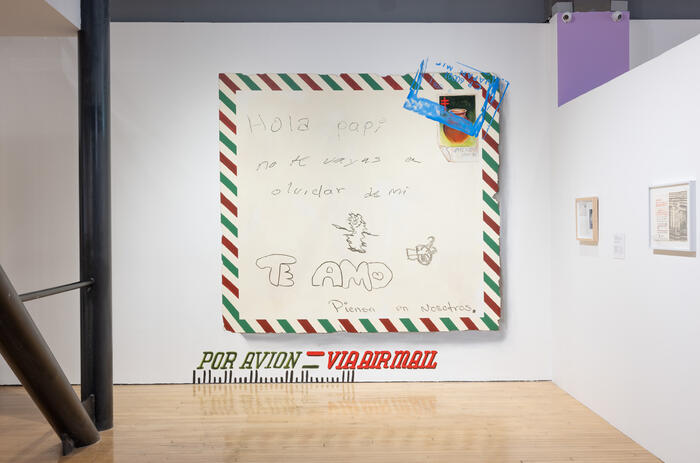

Alongside the Gulf, the Latin American art market has also shown notable strength, particularly at auction, where performance improved meaningfully despite broader global uncertainty. Increased international participation and sustained demand for key modern and contemporary artists point to a market that is gaining visibility and confidence. This momentum suggests that Latin America is increasingly being viewed not as a peripheral category, but as an integral part of the global art market’s search for new collectors and renewed sources of demand. At the same time, it is worth noting the parallel rise in activity among Indian collectors, reflected in strong auction results for Indian modern and modernist artists. Taken together, these developments point to a gradual rebalancing of the market away from its traditional Western centers and toward a more diversified, multi-polar landscape.

Equally transformative is the generational shift underway among collectors. Younger buyers are reshaping demand through cross-collecting practices that blur the boundaries between fine art, luxury, design, digital assets, and cultural memorabilia. For established market players, this presents both an opportunity and a challenge: traditional categories, hierarchies, and sales formats must adapt to remain relevant in a market that is increasingly driven by new sources of capital, new geographies, and new collecting behaviors.

-

Exhibition view of “LATINOAMERICANO. Modern and Contemporary Art from Malba and Eduardo Costantini Collections” in Qatar. Courtesy Malba

Looking Ahead

Taken together, these dynamics suggest that 2025 will be remembered less as a year of recovery than as a year of transition. The rebound seen in the second half was widely anticipated after several years of decline; the more meaningful test will come in the first half of 2026, when it becomes clearer whether renewed confidence translates into sustained activity. What is already evident, however, is that the art market emerging from this period will not simply revert to its previous form. Shifts in supply, generational change, geographic expansion, and evolving business models are reshaping its foundations. For those willing to adapt, the coming years may offer not just recovery, but a redefined equilibrium.