A BUYER’S MARKET: OPPORTUNITIES AMID UNCERTAINTY

Last week's New York auctions, dubbed "Giga Week," saw art sales soar to an impressive $1.4 billion. This significant figure follows numerous sales at bustling art fairs over the past two weeks. While this amount represents a 22% decrease from the same week in 2023, and 55% less from 2022, auction houses performed admirably given the current challenging economic and political climate.

Notably, this season lacked the mega single-owner sales seen in previous years, with no single owner exceeding the $100 million mark. For context, Paul Allen’s collection achieved $1.6 billion at Christie’s in November 2022, Sotheby’s sold the Macklowe collection for over $922 million in May 2022, and the Fisher Landau collection fetched $406 million in November 2023.

The conclusion is clear: it is a buyer’s market. Although there is demand, it is highly selective. A disconnect persists between sellers, who are still considering prices from two years ago, and buyers, who now expect at least a 20% reduction.

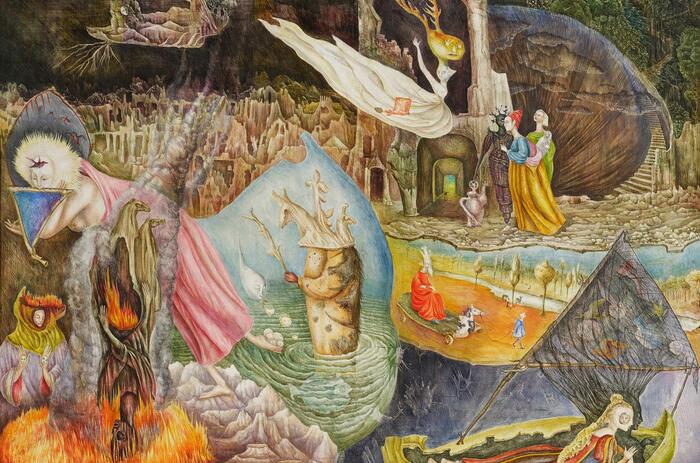

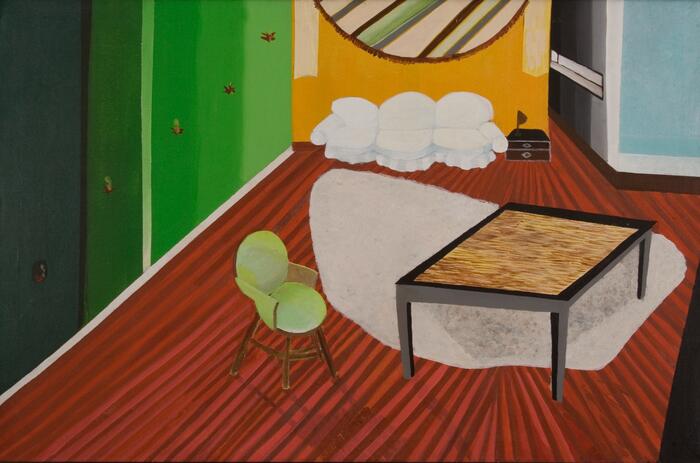

Two types of artworks have performed well: those that are unique with good provenance and fresh to the market, such as Leonora Carrington’s “Les distractions de Dagobert” and Basquiat’s “Untitled (ELMAR),” and pieces by artists with potential for value growth, like historically under-recognized women and some young artists. For example, surrealist women such as Varo’s “Esquiador (viajero),” which sold for $4 million from a low estimate of $1 million, and another Carrington piece, “Who are thou, white face?” which sold for $2.48 million just below the high estimate. Leonor Fini’s «Le train» sold for $444,500, well above the estimate of $200-300K. As far as emerging artists are concerned, although speculation and disproportionate price increases seem to have calmed down, there is still interest in some promising young artists, such as Lucy Bull and Justin Caguiat.

This trend indicates that while there is still appetite and money for art, buyers are cautious and selective, and only unique opportunities will see prices soar. The sale-through rate remains robust, with Sotheby’s and Christie’s achieving over 90% in their evening sales, although many lots sold near the low estimates or sometimes below. This suggests that while auction specialists have adjusted estimates to attract buyers, there is room for further reductions. Auction estimates serve as a guide to the price but are also a negotiation tool with sellers. Balancing attractiveness to bidders with ensuring good returns for sellers is the challenge. Sellers need incentives beyond the famous three D’s (Death, Debt, and Divorce), which remain major reasons for consignments. Other significant incentives are the financial instruments offered by auction houses, such as enhanced hammer prices or the more visible guarantees and irrevocable bids, many of which have been employed this season. In the evening sales, over 50% of the lots often carried in-house or third-party guarantees, many agreed upon shortly before the sale.

In fact, the reality is more complex than it looks, and those promising high sale rates must be carefully scrutinized. Sales are micro-managed, with many lots withdrawn just before the auction, reserves lowered just before sales, and an abundant use of guarantees resulting in good sale rates. This indicates that sellers and auction houses prefer to secure a guaranteed sale, even at the expense of potential proceeds. For example, the $6 million Cecily Brown, which was the cover of The Now sale, was withdrawn before the auction. Similarly, Christie’s much-touted Brice Marden’s “Event,” which had an estimate of $30 million to $50 million, was removed shortly before the evening sale. Christie’s explained they had decided to wait until the market felt “right”. In other words, they realized that it was not going to sell at that price and preferred to withdraw it rather than sell it for a lower price or risk burning it. Auction results are public, and this week's results are the basis on which many appraisers, insurance companies and future sales will be benchmarked.

These practices highlight the importance of examining the full picture when considering reported sales figures. When we look at the daytime auctions, that feature works of lower values than the evening auctions and are more reflective of market reality, the results are slightly more positive. Especially for lots with estimates below $50,000, the hammer ratio (which determines the performance of a lot relative to its pre-sale estimate) is higher. In other words, there is still interest and room for growth in that segment.

All three auction houses featured works by the recently deceased Frank Stella. Contrary to the usual expectation that an artist's market value rises posthumously, this time proved different. Phillips' evening sale piece went unsold, while Christie's and Sotheby's sales hovered close to their low estimates. Why weren't there better results? Was it simply too early, with buyers waiting for either lower prices or exceptional examples? While the public and sellers often anticipate spectacular results well above high estimates, disappointment can set in when these expectations aren’t met. However, last week's auctions did offer some magical moments. Leonora Carrington’s “Les distractions de Dagobert” soared from an estimate of $12-18 million to a hammer price of $24.5 million ($28 million with fees). Sotheby’s The Now sale saw record prices for promising young artists with upside potential, with Lucy Bull’s 2020 painting attracting a bidding war among eight eager bidders, doubling its $700,000 high estimate to $1.45 million ($1.8 million with fees).

The highest price of the week was claimed by Basquiat’s “Untitled (ELMAR)” at Phillips, which sold for $46.5 million. This masterpiece, from the artist’s most sought-after year, featured excellent provenance, having been sold by the family of the respected connoisseur Francesco Pellizzi, who bought it in the early 80s directly from Basquiat’s first dealer, Annina Nosei. The painting’s significant exhibition history includes a notable feature in Basquiat’s 2018 retrospective at the Fondation Louis Vuitton in Paris. A good piece, fresh to the market and backed by strong provenance, is always a winning formula. However, the real challenge in this turbulent market often lies in securing such high-caliber consignments rather than selling them.

Christie’s presented the most significant single-owner sale, the Rosa de La Cruz collection, featuring 26 guaranteed lots (with many more consigned for future auctions). The sale performed well, with only a Martin Kippenberger piece withdrawn before the start, and all other items sold. The auction achieved a hammer total of $28.1 million ($34.4 million with fees), comfortably within the pre-sale estimate of $25 - $37 million. The standout lot was Felix Gonzalez-Torres' "Untitled (America #3)," which hammered at $11.3 million ($13.6 million with fees) after competitive bidding from three parties, establishing a record for the artist. The previous auction high for a Gonzalez-Torres piece was $7.7 million, set in 2015. Christie's estimate likely considered this benchmark along with private sales of similar works at David Zwirner, which now represents the artist’s estate and are said to sell for $10 million. Felix Gonzalez-Torres was the first contemporary artist collected by the De La Cruz family. They became good friends, and he encouraged Rosa to become more involved in contemporary art. Many other lots achieved strong results, including those by Ana Mendieta, whose auction record was reset twice during the evening amid fierce bidding. The Rosa de La Cruz’s prestigious collection, exhibited in their museum and curated with passion by a major recognized collector, contributed to the strong results, demonstrating why auction houses compete fiercely for major single-owner collections.

To wrap up, the art market is currently in a down phase, likely not yet at its lowest point, as part of the natural cycle following the sales boom of 2021 and 2022. The prevailing economic and political uncertainties, including the looming US elections, add to the market's unpredictability. However, for those with a sharp eye, opportunities abound.